Payroll preparation: a step-by-step guide for HR professionals

If you’re responsible for running payroll in your organization, you know how valuable it is to speed up and simplify this complex process.

This is especially true if you’re relying on manual methods or tools that are no longer suitable for your growing operations; in these circumstances, preparing for payroll every month can quickly become overwhelming. Inefficient payroll management can also drain your resources, with even small business owners spending almost five hours calculating, filing, and remitting taxes each pay period.*

Payroll is a business-critical task in any company, and it’s crucial for keeping your employees happy and your systems compliant with tax and labor laws.

Fortunately, you can simplify and streamline these processes by following our step-by-step guide to payroll preparation and implementing user-friendly tools designed to help you manage payroll more efficiently.

*Bloomberg, 2020

👀 Explore Leapsome in just 5 minutes

Learn how market leaders use our HR management tools to support high-performing teams.

👉 Take a quick tour

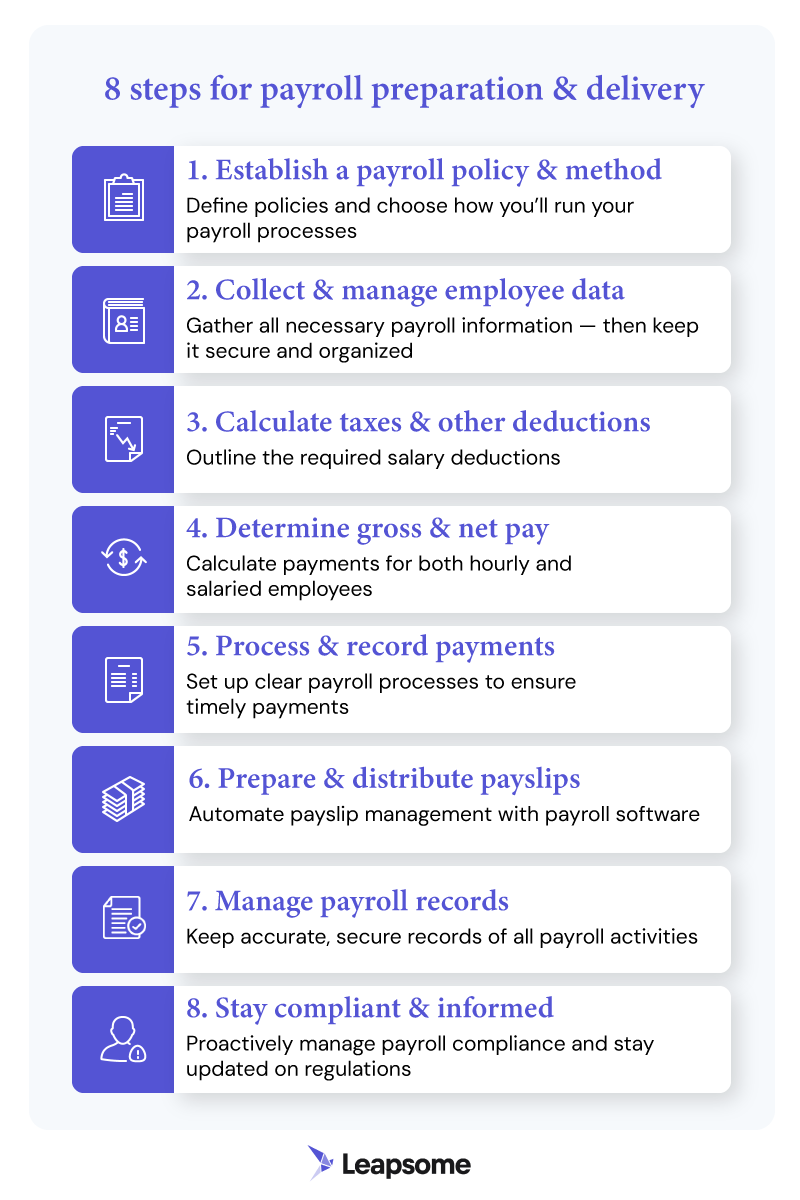

8 steps to running payroll within your organization

Does payday fill you with dread? You’re not alone.

Payroll can be tricky for even the most well-equipped human resources (HR) teams. However, with the right frameworks and know-how, it doesn’t need to be frustrating.

Modern, people-centered HR platforms like Leapsome allow you to integrate payroll with other core HR processes — presenting new opportunities to simplify your tech stack and centralize employee data.

Wondering where to start? We’ve outlined eight key payroll preparation steps to follow so you can manage your payment systems with confidence.

1. Establish a payroll policy & method

First, decide on the payroll model you’ll use; consider which type of system will best suit your business and think about factors like company growth projections, tax requirements, and local compliance regulations.

There are three main options:

- Manual payroll — doing everything yourself and keeping records by hand

- Outsourced payroll — handing your payroll processes over to a third party

- Payroll software — using a tool or platform to automate and manage payroll

Once you know which model you want to implement, you can begin establishing a robust payroll policy for your organization.

A standard payroll policy should include:

- Workweek definitions

- Time and attendance expectations

- Break periods

- Overtime pay

- Pay periods and methods

- Mandatory and voluntary deductions

- Payroll benefits

- Recordkeeping policies

Of course, you’ll also need to ensure that your HR and finance departments can track all the above data. For example, our CoreHR tool (coming soon with Leapsome’s HRIS) provides user-friendly features for critical functions like time tracking and absence management.

📈 Elevate your people strategy

Unify your people and payroll data with Leapsome’s new HRIS tool — coming soon!

👉 Join the waitlist

2. Collect & manage employee data

Next, gather payroll-related information from all team members to ensure you can pay them quickly and correctly.

At the very least, you’ll need employees’ full names, home addresses, bank account information, and any tax forms or identification numbers required to process payments in your country. These records must always be accurate and up-to-date to ensure your organization complies with tax, labor, and data protection laws.

A robust employee document management system is also a must for HR team members to record deduction approvals and data collection consent. It’s essential that this kind of software complies with the data protection regulations that apply to your industry and region to avoid legal complications. For example, the document management feature within Leapsome’s HRIS allows you to create, upload, and manage company-wide documents and templates to ensure accuracy and compliance through multiple levels of approvals. In addition, our platform places a strong emphasis on security and compliance, incorporating robust measures to prevent authorized access and ensure adherence to global data protection regulations such as the GDPR.

Ask yourself these questions to keep your organization’s employee data in safe hands:

- Do we have a disaster recovery plan to restore payroll data in case of failure or breach?

- How often do we back up employee and payroll data?

- Where are these backups stored?

- Do our data and payroll processing frameworks align with information security laws?

💡 Many HR teams have employee information spread across different platforms and tools.

When the time comes to update a team member’s personal data, process payroll, start a performance review cycle, or run an engagement initiative, human resources workers may have to toggle back and forth between tools — and, even worse, manually transfer data between them. Doing so is not only inefficient, but unsafe.

Choosing a people-first HR platform like Leapsome is the answer. Our software is easy for employees and HR professionals to use, and means you can take care of different people management tasks in one intuitive space.

3. Calculate taxes & other deductions

Now that your payroll system is organized, you can begin working out your team’s regular payments. To do that, start by calculating the deductions each employee must pay.

What deductions entail varies depending on where you’re based. Common elements include:

- Income tax

- Social security and retirement contributions

- Private and national health insurance

- Life or disability insurance

- Union fees

- Loan repayments

- Transportation

- Voluntary contributions (e.g., personal savings and donations)

Getting deductions right is crucial for meeting legal payroll requirements. So, be sure to use payroll software to automate these calculations and consult a tax professional in your area.

4. Determine gross & net pay

Once you’ve outlined employee deductions, you can start processing payroll. This begins with determining employees’ gross pay (the total amount of money they earn before deductions) and net pay (the “take-home pay” they receive after deductions).

Gross pay calculations differ between salaried and hourly employees.

For salaried employees:

- Annual salary ÷ number of pay periods = gross pay per period

For hourly employees:

- Number of hours worked during the pay period (including overtime hours) x hourly rate = gross pay per period

Then, to calculate team members’ net pay, subtract the employees’ recorded deductions from their gross wages to determine how much to pay them.

💡 Don’t forget: you’ll need to withhold, match, and manage certain deductions for employees. For example, you must remit tax deductions to the relevant authorities with the rest of your payroll taxes as frequently as legally required.

5. Process & record payments

Finally, you’re ready to make your payments! You’ve done all the groundwork, so now it’s all about establishing, maintaining, and communicating transparent payroll processes that ensure your workers get paid on time, every time.

There are many ways to pay employees — from international transfers to direct deposits. Whatever method your organization prefers, it’s essential to:

- Always have sufficient funds to cover employee wages by using integrated software systems to view and prepare for upcoming payments.

- Authorize and schedule payments ahead of time to make sure nothing prevents payroll from going through when it should.

- Check payroll to identify inconsistencies or errors that might cause compliance issues or employee complaints.

Be sure to have reliable systems for documenting all the timesheets and transactions in your company’s accounting software. This is essential to staying organized and meeting legal and financial obligations.

6. Prepare & distribute payslips

Payslips are essential documents for both employers and staff. Every person working at your company should receive one every time they get paid — usually biweekly or monthly and in a digital format.

Typically, payslips include the following information:

- Business name, address, and contact information

- Employee name and tax ID number

- Breakdown of the employee’s gross pay, deductions, and net pay

- Summary of the employee’s cumulative pay so far in the tax year

Payslips for hourly workers should include the hours they worked during that pay period and any additional overtime.

To avoid confusion, produce and distribute payslips at regular intervals and in a consistent format. Communicating payroll schedules and outlining where to direct queries will ensure everyone knows when to expect their slips and what to do if they’re incorrect.

🤔 Struggling to stay on top of payslip preparation? Adopting a payroll tool like the one within Leapsome’s new HRIS can help automate distribution to reduce the risk of human error and give your HR team members one less thing to do.

7. Manage payroll records

Keeping accurate, secure records of all payroll activities is essential. This information is useful for salary benchmarking and internal financial reviews and is also crucial for tax, compliance, and data protection purposes.

Here are some examples of payroll records you might need to keep:

- Employee contracts and agreements

- Personally identifiable information (PII)

- Tax withholding forms, payments, and filings

- Deductions and benefits contributions

- Employee banking authorizations

- Audit and compliance trails

- Sickness or holiday leave

As you can imagine, maintaining these records can be time-consuming and complicated. However, with user-friendly HR software like Leapsome HRIS, monitoring payroll history and payment data is faster and easier.

Our software automates routine recordkeeping, saving HR and people professionals hours of mundane data entry. This boost in productivity allows departments to reallocate budgets where they’re needed most.

8. Stay compliant & informed

Congratulations! You’ve successfully streamlined your payroll cycle to deliver timely, error-free payments to all staff members.

Sadly, the job isn’t done once you’ve sent the last payslip. Like your business, your people’s circumstances constantly change, and it’s your responsibility to have their most up-to-date personal information in your data records.

It’s also crucial to be aware of changing payroll service regulations. That means continuously reviewing the tax laws and guidelines where your business operates and adjusting your processes accordingly. Many companies face payroll penalties due to non-compliance issues, highlighting just how many businesses struggle with this aspect of payroll preparation.

Simplify payroll preparation with an integrated HR platform

Payroll management can be challenging for organizations of all sizes and sectors. However, the right tools and processes can simplify the process of preparing for each payroll period.

We’ve identified the eight key steps you must follow to ensure you don’t miss a thing. Using this payroll preparation framework will benefit your business in many ways — making it easier for HR teams to collect the information they need, deliver seamless payment experiences, maintain legal and regulatory compliance, and get a better handle on payroll expenses.

And that’s not all. With Leapsome’s interconnected suite of HR tools, you can take these capabilities one step further. Our payroll tool slots seamlessly into our wider people enablement platform, which encompasses features for Reviews, Goals, Feedback, and Compensation, just to name a few.

Together with Leapsome’s HRIS tool, these tools help engage your people, align your teams, and further streamline your internal operations — enhancing efficiency and optimizing HR workflows for smoother experiences across the board.

🚀 Engage your team with Leapsome

Schedule a trial to see how our #1-rated HR platform for people enablement works.

👉 Book a demo

Ready to upgrade your people enablement strategy?

Explore our performance reviews, goals & OKRs, engagement surveys, onboarding and more.

.webp)

.webp)

Request a Demo Today

Request a Demo Today

.png)